0860 22 22 88

0860 22 22 88

[email protected]

[email protected]

Helpdesk hours: 8h00 to 16h00 Monday to Friday.

1 Adderley Street

Cape Town

Check your fund balance here: Register/Login

E-Forms

Please ensure that you complete the correct form and supply all the necessary information and supporting documents where required.

The more comprehensively you complete forms, the more speedily and efficiently will the administrators process your claim.

Forms to complete

All forms must be sent through to [email protected]

Installation Form

To be completed when: an employer becomes a participating employer

Supporting documents required:

- Initial billing schedule

- Company registration documents

- Employer Portal Registration Form

- Personal Liability Form

Personal Liability Form

To be completed when: an HR representative is appointed as a responsible person for ensuring payment of retirement fund contributions

Employer Portal Registration Form

To be completed when: an employer wishes to convert to the online administration system

The completed form signed by the authorised persons.

New Member Entry Form

Withdrawal/Retirement Form

Requirements:

- Copy of members’ ID

- Member’s personal tax reference number

Beneficiary Nomination Form

The death and funeral benefit beneficiary nomination forms have now been combined. It is extremely important that BOTH sections are completed in full. Once completed hand a copy to your employer and email a copy to [email protected]

Disability Claim Form

Requirements:

- Certified copy of members identity document

- Proof of banking details and payslip of last month/week that member was physically at work i.e. not when on sick leave or annual leave or last date actually paid by the employer

- Confidential medical report

Death Claim Form

Requirements:

- Bank statement of Spouse / claimant

- Bi 1663 form – notification of death

- Certified copy of death certificate

- Certified copy of Members identity document

- Certified copy of spouse/claimants identity document

- Completed Death Claim Form

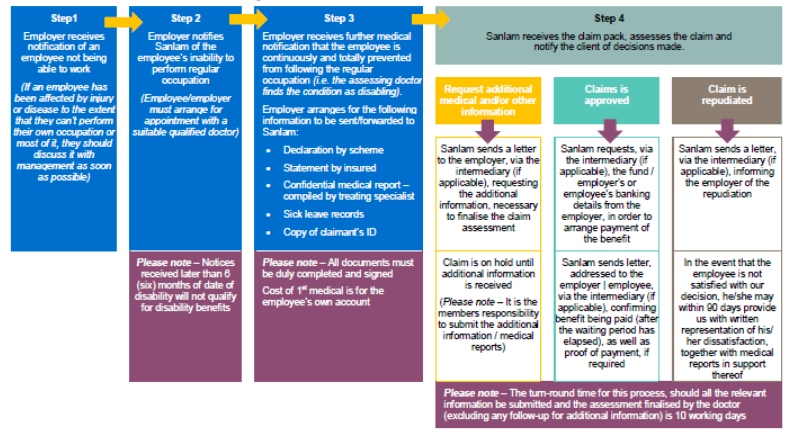

Submission of Disability Claims

This flowchart is a summary of the disability claim process, for more details click here: Sanlam Disability Claims Process 2019

Submission of Funeral Claims

The completed Sanlam Funeral Claim Form including the following supporting documents must be submitted to Fax: 021 449 5882 or e-mail to [email protected]

• Bank statement of spouse/claimant

• Bi 1663 form – notification of death

• Certified copy of Death Certificate

• Certified copy of member’s identity document

• Certified copy of spouse/claimants identity document

Submission of Death Claims

The Sanlam Death Benefit Claim Form must be completed in full.

A copy of the member’s ID, the death certificate and the members personal tax number must be submitted with the claim form to [email protected] or fax 021 449 5882.

• The death benefit is payable in terms of Section 37C of the Pension Funds Act and a full investigation will be conducted to determine who the payments will be allocated to. A help desk consultant will contact the employer and the family of the deceased to obtain any additional information and documentation. All information is forwarded to the Board of Trustees for approval of the allocation of the death benefit lump sum. When tax-clearance from SARS and Trustee approval on the allocation of the death benefit lump sum have been received, the benefit is paid.

Funeral Benefit

Sanlam must be contacted directly on 0860 732 548/9 or, alternatively, please contact the Help Desk on 0860 22 22 88 for more information. Click to download the following forms:

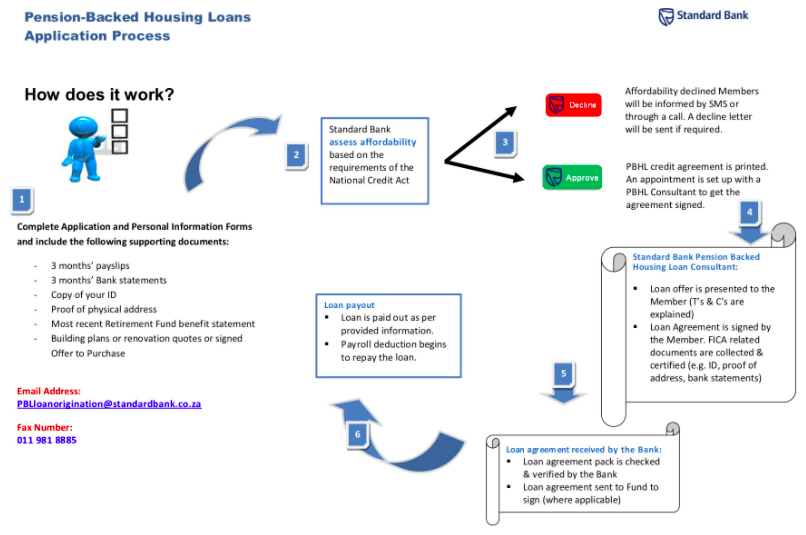

Housing Loans

The employer must have an agreement with Standard Bank as you will be responsible for deducting the loan instalment from the member’s salary. The member is required to contact the help desk, who will be able to provide them with the surety amount (maximum amount they can apply for). The member will then be required to complete the application form and submit the supporting documents to the Help Desk – [email protected] | 0860 22 22 88. The Help Desk will then submit the application form to the bank.

Standard Bank will contact the member directly to advise whether their loan has been approved; if yes, the money will be paid directly into the member’s bank account. The instalment must be deducted from the member’s salary on a monthly basis and paid directly to the Bank.

Download the diagram below here

Fund Transfer Details

This form is used as and when a member leaves or joins the Fund and wants to transfer the benefit they have accrued in another fund to our fund or from our fund to their new fund.